Assorted historical stuff:

Association Against Prohibition Amendment estimates last year's cost at $959.9M; about 90% is lost Federal revenue, remainder lost local revenue and costs of enforcement. Finnish Education Min. P. Virkkunen calls prohibition in Finland "chief source of intemperance, as well as failure on economic grounds."

Survey of 100 Detroit drivers held for violating traffic rules finds "42 were classified as of inferior intelligence, 12 as definitely feeble-minded, one as insane, and three as physically handicapped." Also, 46 were impaired by alcoholism, and only 13 were completely clean.

Building and loans plan to raise $1B new assets in next year; released for home-buying, this should raise US percentage of homeowners.

Next Congressional session in December will, among several big items, include a major inquiry by Senator Glass concerning banking in general and the role of Federal Reserve credit in speculation; also, regulation of wire and wireless communication, railroads, and power companies.

Navy completion of aircraft program in next two years will leave it with 1,000 planes vs. 354 in 1926.

Reichstag rejects most of Fin. Min. Dietrich's proposed taxation program.

New York State plans to finance future road construction from current revenues rather than public borrowing.

Central Park horse riders are supplied by 20 stables with average of 50 horses each; charge $2-$4/hour per horse. Midnight rides after theater are popular. Probably only place in the country that stables are still doing well.

International phone service to Lithuania now available; 3-minute call is $35.25, each additional minute $11.75.

New York State paid $928.5M of Federal taxes for year ended June 30, of a total of $3.038B from all states.

Market commentary:

Bulls encouraged by recent rally and technical indicators of strength. Buy orders accumulated over the weekend, leading to an opening rally with new rally highs for many major stocks. Speculative issues were particularly active. Oils, food, amusement, communication, utilities, banks strong. Most stocks closed at daily highs.

Good signs seen in rise in life insurance sales and bank deposits vs. 1929.

Leading traders seen buying; "They are picking out stocks strong in intrinsic value, with potentialities of a quick comeback when business returns to normal."

J.C. Stone, member of Farm Board, believes wheat prices have bottomed, says Board has no plans for stabilizing this year's crop.

Netherlands Trading Society report on Holland: "The curve of the business cycle is still tending downward, without, however, having so far assumed severe proportions."

Economic news and individual company reports:

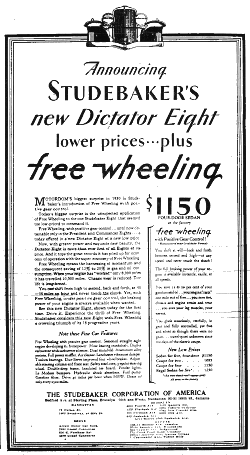

Auto industry successful in reducing inventories by drastically cutting production. Current stock is well under 400,000 units compared to 559,000 in April of 1929. This amounts to less than eight cars a dealer. Production in June estimated at 343,000 cars and trucks vs. 567,424 in June 1929; half of production was by Ford.

New cartels being formed to control zinc and bottle production.

Australian trade awful; in 9 months ended March 31, imports down $6.2M from 1929; exports down $166.8M; trade deficit now $177M. Total debt is $5.6B [vs. $2.3B GNP].

May freight traffic on class 1 rails was 36.6B net ton miles, down 12.8% from 1929 and down 6.8% from 1928.

95 public utilities total May revenues $195M vs. $198M in April and $189.8M in May 1929; earnings $86M vs. $89M and $82M.

GE first-half earnings $1.01/share vs. $1.07/share in 1929.

A&P first-half sales $548M, up 8% from 1929; June sales also up 8% from 1929. Remodeling stores to attract "that part of the public that patronizes better shopping districts and demands unusual varieties and costly delicacies."

Joke:

“Applicant ... 'I may say I'm pretty smart. I won several prizes in cross-word and word-picture competitions lately.' Employer: 'Yes, but I want someone who can be smart during office hours.' Applicant: 'This was during office hours.'”

+ The Boring Stuff:

Editorial: Measuring the current state of business compared to 1929 may be too pessimistic since the first half of 1929 was "abnormally" active. However those who say production is only 4% behind the prosperous year of 1928 are being too optimistic, since they ignore increases in operating expenses and capital investment in the past two years. This causes earnings to decline more than revenue. Finally, price reductions are also taking a toll on earnings, but these are ultimately "the great corrective for depression" since they reduce production and increase consumption.

Commodities mixed; cotton slightly lower, wheat down early but rallied to close higher. Bonds started moderately active and stronger but slowed down later.

Editor: It's a good market for traders: “Isn't it safer to buy on the breaks and sell on the bulges now than it was last year when stocks were a great deal higher?”

Oil companies boosted by new hydrogenation process developed by Standard Oil NJ and IG Farben and to be shared with other oil companies.

New NYSE securities listed in June $784M vs. $1.140B in May and $1.862M in 1929; bonds $122M, $441M, and $304M; stocks $662M, $699M, and $1.557B.

Canada May business failures 166 with liabilities $2.601M vs. 194 with $5.025M in April and 183 with $2.295M in May 1929. Bell Canada reports telephone revenues down substantially so far in 1930, but notes recent improvement; outlook much more encouraging than a few months ago.

US and Canada newsprint shipments for first half were 1.938M tons vs. 2.015M tons in 1929.

June crude rubber consumption by US manufacturers 34,463 tons vs. 39,902 tons in May and 43,228 in June 1929.

Tin producers' announced actions, including production curtailment, unsuccessful so far in supporting prices.

American Rayon industry has curtailed production from predicted 162M pounds to under 80M. This should be well under American demand. However European overproduction is still possible, and silk is now so cheap it's competing with higher-grade Rayon.

Land O'Lakes Creameries, a large butter cooperative, announces new action to support butter prices.

AT&T first-half earnings $5.71/share versus $6.15/share in 1929. W.S. Gifford, president, says business activity for first half was below record level of 1929 but compared favorably with 1928; company plans to spend a record $700M on additional plant facilities in 1930.

Pennsylvania Railroad first 5 months revenues $242.9M, down 10.9%; operating income $38.2M, down 27.7%.

Western Union first-half net $4.22/share vs $7.44/share in 1929.

National Biscuit reports Q2 earnings $.80/share vs. $.68/share Q1 and $.81/share in 1929. United Biscuit Q2 $.98/share vs. $.89/share in 1929.

Federal Water Service net for year ended May 31 was $3.01/share vs. $2.85 in 1929. Detroit Edison net for year ended June 30 was $10.02/share vs. $11.02 in 1929.

Oklahoma Nat. Gas profit for year ended May 31 was $4.77M vs. $4.43 in 1929.

L.A. Young Spring & Wire first half earnings $2.62/share vs. $3.69/share in 1929.

Worthington Pump expects first half net about equal to 1929; helped by operating efficiency, pipeline demand.

Emil Klein (cigars) first half net $1.22/share vs. $1.21 in 1929.

No comments:

Post a Comment